“Sell in May and Go Away” Posts Another Fail

Refuse to Let Anecdotes Destroy Your Portfolio

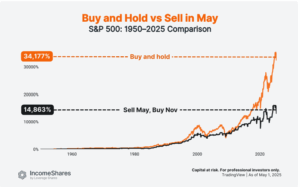

The old market adage “sell in May and go away” fell flat this year. The S&P 500 recorded its best May since 1990 – up 6.08% despite a rough April. If you dumped positions in April based solely on that saying, you may have locked in losses that are now even harder to recover from.

That knee-jerk reaction is exactly why anecdotes and emotions are horrible advisors. Let’s break down what happened (and why you shouldn’t let sound bites control your portfolio).

Why Emotional Selling Creates Permanent Losses

-

April’s Pain Became May’s Regret

• If you “sold in May,” you missed out on a 6% bounce.

• Those temporary drop-off losses rapidly became permanent because timing the market is rarely “easy” without a robust process. -

Pandora’s Box of Catch-Up

• Jumping out of the market in April means you now face the double-edged challenge of redeploying capital:-

When to reinvest – too early, and you risk another pullback.

-

Too late, and you miss the next leg up.

– Playing catch-up without a clear system often results in additional mistakes.

-

-

Media Hype Fuels Fear Bias

• Tariffs. Federal-funds rate worries. China headlines. AI fatigue.

• None of these trends vanished. Yet the market shrugged them off because growth drivers remain intact.

• If you waited for a “doom-and-gloom” confirmation, you’d have missed May’s rally entirely.

“Sell In May” underperforms even the easy Buy-n-Hold strategy.

Data Over Drama: Growth Trends Are Intact

Recent economic and corporate data illustrate that:

-

Exponential growth trends (technology adoption, corporate earnings) continue to accelerate.

-

The financial system is still on the hunt for “the next winner”. Not buyers of panic-priced assets.

-

Volatility may return (especially around earnings seasons), but the long-term trajectory remains upward.

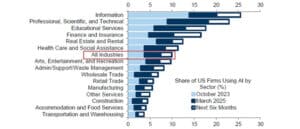

AI is more than a fad or passing pump. It’s shaping up to a big a huge secular trend that may hold up against economic weakness. Given the low but expanding adoption of AI, we believe these are early stages of growth from this technology and the impacts it will bring to industry could potentially hold up against many of the doomsday economic headlines were currently going thorugh.

Ai Adoption by Industry Source: Goldman Sachs April ’25

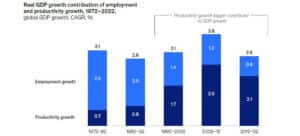

It’s important to consider what the fast evolution of AI has done to productivity, although early, we can see that productivity growth has been a growing contributor to GDP growth. With the adoption curve accelerating, we expect these dynamics to continue to expand.

Real GDP Growth Contribution of Employment, source McKinsey June ’23

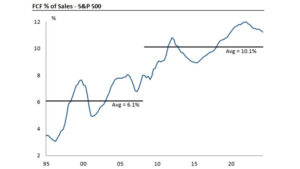

While the common measure of Price/Earnings remain elevated, it is important to note that US companies have taken on asset-light business models over the past 10+ years. Looking at Price/Free-Cash-Flow as a metric for the changing landscape, these P/FCF levels are much more attractive.

US Equities Free Cash Flow as a Percentage of Sales Since 1995 for the S&P 500 Index, Source UBS. March ’25

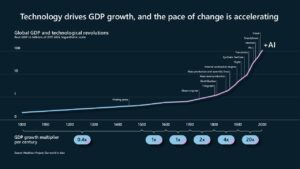

While many in media see the tectonic shifts this recent wave of technological innovation as destructive to humanity, we consider previous cycles of innovation as our guide. This cycle, including AI is ultimately going to create more jobs than it destroys.

Technology Has Accelerated GDP Growth Source: Microsoft May ’25

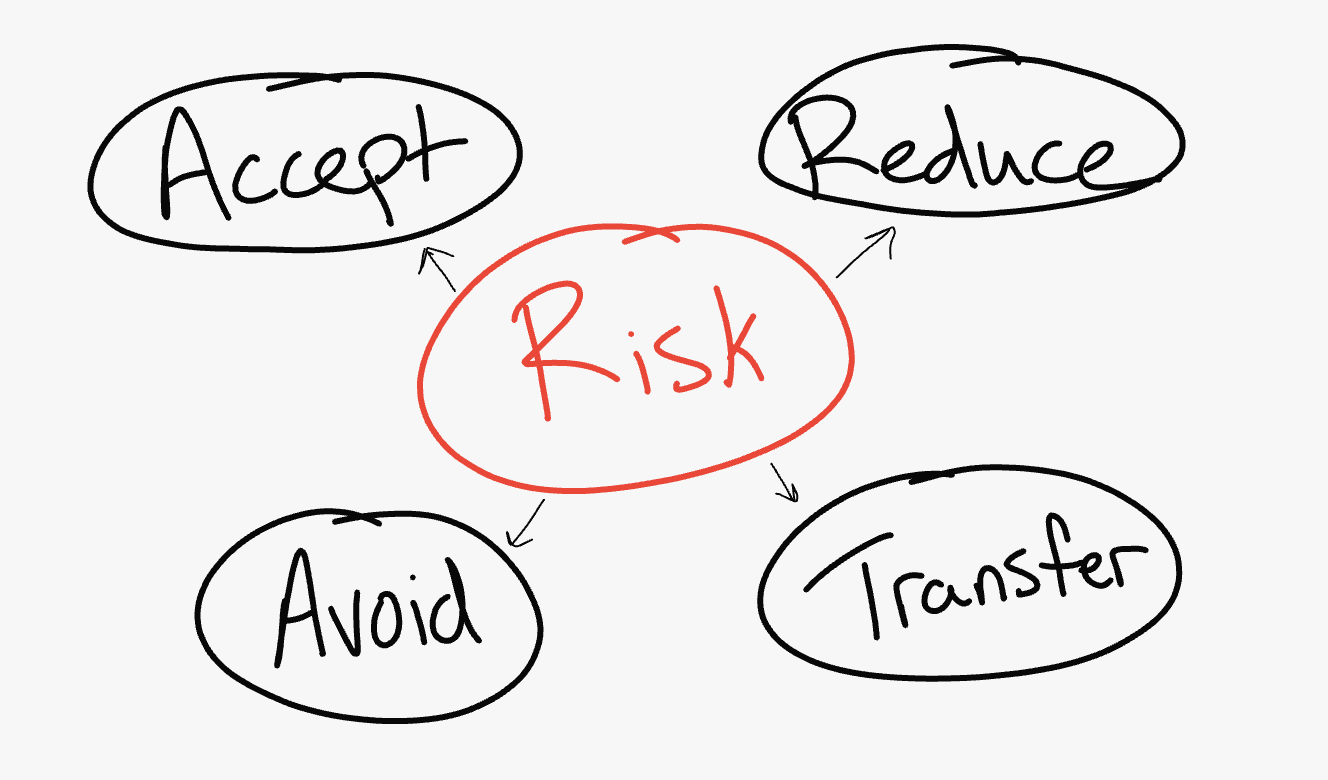

Process Over Panic: Steps to Fortify Your Portfolio

-

Reconsider Your Investment Process

• Do you have clearly defined entry/exit rules?

• Are you forcing trades based on headlines (e.g., “sell in May”) rather than fundamentals and trend signals?

• Build guardrails: limit orders, predetermined stop-loss levels, or rebalancing thresholds. -

Consider Cheap Hedges

• If volatility spikes, a modest hedge (e.g., an inexpensive options collar or sector-specific inverse ETF) can cushion drawdowns.

• Don’t let fear dictate headline‐driven trades. Use hedges as insurance, not panic tools. -

Evaluate Each Position’s Role in Your #FiPlan

• Does this holding align with your long-term financial plan: time horizon, risk tolerance, and growth targets?

• If the answer is “no,” adjust weightings or trim positions that no longer serve.

• If it still fits, hold steady and let the process work.

The Ride Will Be Bumpy. But Your Process Can Be Rock-Solid

Markets will always be unpredictable. Headlines will always chase the next scare.

But if you build a disciplined process – rooted in data, trend analysis, and structured risk management, you can:

-

Ignore the noise around “unprecedented” shifts that never truly pan out.

-

Stay invested in high-quality trends rather than reacting to every scare story.

-

Capture opportunity when others are paralyzed by anecdotes and fear.

Remember: “Sell in May” is just a catchy meme. Real money is made (and saved) by following a process that you trust, especially when the crowd is running for the exits.

Action Steps: Lock in Process, Not Panic

-

Review Your Rules

• If you have a documented buy/sell plan, validate it.

• If you don’t, create one: define triggers for rebalancing, hedging, and adding to positions. -

Run a “What If” Scenario

• Ask: “What if May 2025 closed up 6%, how would that impact my current holdings?”

• Use that insight to stress-test portfolios; ensure you’re not loading up on positions that flip to “hard no’s” at the first sign of pain. -

Schedule a Process Check

• Once per quarter, audit your performance vs. your rules and adjust for market regime shifts (e.g., moving from growth to value, rising rates, inflation dynamics).

• Mark it on your calendar. Don’t let emotions hijack your decision making.

#FinSights #ProcessOverPanic

What’s one step you can take today to strengthen your investment process, so you’re not swayed by the next catchy headline?

Action Tips for Readers:

-

Bookmark this in your “Market Myths” folder.

-

Share it with anyone who’s quick to sell based on viral headlines.

-

Check back weekly for fresh insights – rooted in facts, not fear.