April Jobs Report + Personal Update: Labor Market Is Cooling, But Fed Still Sitting on Its Hands

We’re blessed to share some exciting personal news: our newest addition, Martyna, was born on April 22nd. She’s healthy, constantly hungry, and doing all the classic newborn things: mostly keeping my wife and me up at night.

We’re blessed to share some exciting personal news: our newest addition, Martyna, was born on April 22nd. She’s healthy, constantly hungry, and doing all the classic newborn things: mostly keeping my wife and me up at night.

Meanwhile, Milena, our fifth, is settling beautifully into her role as a big sister. We’ve got a fundraiser coming up and possibly a breakthrough on a medical trial later this year, more on that soon.

Onto Business

April’s payroll report confirmed what many already suspected: the U.S. labor market is still resilient, but clearly cooling. It’s not collapsing (despite recent media hysteria), but we’re seeing signs of a gradual, linear softening.

What Just Happened?

- Nonfarm Payrolls: +177k (vs. 138k expected)

- Private Payrolls: +167k

- Revisions: -58k from prior months

- Wages: +0.2% MoM; +3.8% YoY (softer than expected)

- Unemployment Rate: Steady at 4.2%

- Prime Age Employment: Rebounded after 2-month slide

TL;dr: Solid but cooling, very Goldilocks. But we’re not breaking out the champagne.

What It Means

- The job market’s slowing down organically, not crashing.

- Wage growth is decelerating. Hiring is flat. Slack is building.

- Tariff effects haven’t shown up, yet. But May or June may tell a different story.

Under the Hood

- 3-Month Avg Payroll Growth: 155k (pre-pandemic avg: 178k)

- Cyclical Employment: Up, led by construction

- Temp Help: First uptick since December

Red Flags:

- Permanent job losses at a new cycle high

- Duration of unemployment trending higher

- Manufacturing hours contracted 0.9% YoY

- Wage growth annualized at just 2.6% over the past 3 months

Add in weak JOLTS data; job openings down, quits flat, and we’re staring at a labor market in neutral.

The Fed’s Dilemma

Despite clear red flags, the Fed isn’t budging.

- Tariff drama and political pressure have clouded the outlook

- Inflation hasn’t cooled enough for cuts

- So the Fed’s stance = passive tightening

Bottom Line

This wasn’t a disaster, but it wasn’t strong either. We’re grinding lower, not blowing up.

Here’s the kicker: If it weren’t for tariffs, the Fed might have cut rates today.

Instead? They’re stuck in neutral until at least July.

What to Watch:

- May/June payrolls (will tariffs show up?)

- Wage growth (continued deceleration = concern)

- Confidence surveys (still shaky)

Why We’re Calling for a Mild Recession

The data is pointing to a mild, income-driven recession, not a balance-sheet collapse:

- Caused by slowing wage growth, cautious spending

- Recoverable with monetary policy support

Why we’re confident:

- Household and corporate balance sheets are strong

- No widespread deleveraging in sight

The labor market is cooling – not collapsing.

The labor market is cooling – not collapsing.

- April’s 155k 3-month average is respectable

- Private payrolls grew ~150k over the past 3 months

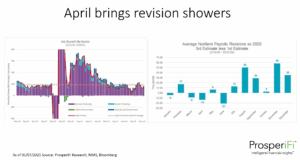

- But April tends to get revised lower (-13k average post-2005)—this data may not age well

Fed Chair Powell wrapped today’s meeting with no surprises. No cut.

Fed Chair Powell wrapped today’s meeting with no surprises. No cut.

- #RatesHigherForLonger is still the theme

- Market now expects cuts by July or September

- Holding rates steady in a cooling economy = passive tightening

The Real Risk?

Confidence.

- Tariffs haven’t nuked the economy, but they’re a steady headwind

- Soft data is shaky, hard data is cooling

- Market participants are bracing, not panicking

We’re likely past the risk of extreme downside but not out of the woods

Right now, we’re wondering: Is this the soft landing everyone hoped for, or just the calm before the real slowdown?

August ’24 soft data rate cuts vs april ’25 soft data hold

Sept 2024: soft data weak, rates cut 50bps post-August crash

May 2025: soft data worse, no cut post-April crash

Where’s the consistency?

Despite the uncertainty, markets are functioning. The consumer is still spending. Businesses are still operating. If anything, today’s caution could be tomorrow’s acceleration.

If you’d like help aligning your strategy to today’s economic signals, schedule your Future of Wealth Assessment here. Happy to help.

And if you found this update helpful—feel free to forward it to someone who might benefit.

Data by day. Diapers in the evening.

Kris Garlewicz, CFP®