Understanding Earnings and Valuations

The stock market’s performance is fundamentally driven by two variables: earnings and valuations. A company generates profits, and investors assign a multiple to those profits; such as 15x or 20x earnings, to determine the company’s overall valuation. In 2025, earnings have come sharply into focus, particularly as policy uncertainty surrounding tariffs and global trade continues to unfold.

With Q2 earnings season set to begin in mid-July, now is an ideal moment to reflect on how companies performed during the first quarter of the year. Though businesses and economists initially raised concerns over rising input costs, disrupted supply chains, and slower economic growth, the actual Q1 earnings suggest the negative impact was limited.

Q1 Earnings Exceed Expectations

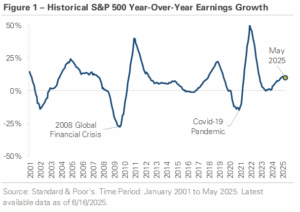

Figure 1 below illustrates the S&P 500’s trailing 12-month earnings growth from 2001 through May 2025, calculated by comparing the most recent 12 months’ earnings against those of the prior 12-month period. Impressively, earnings for the S&P 500 grew by +10% in Q1, demonstrating that corporate America continued to deliver strong results despite widespread policy concerns.

Figure 1:

“S&P 500 Trailing 12-month Earnings Growth (2001–May 2025)”

Sector-by-Sector Breakdown

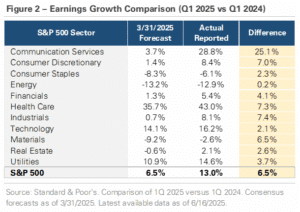

To eliminate seasonal effects, like winter weather or holiday spending – and clearly assess underlying trends, Figure 2 compares Q1 2025 earnings results for each sector of the S&P 500 to those from Q1 2024. The analysis reveals how actual performance stacked up against Wall Street forecasts:

-

First Column: Earnings growth forecasts as of March 31, 2025.

-

Second Column: Actual reported earnings.

-

Third Column: Difference between reported and forecasted earnings.

Across the board, the S&P 500 earnings grew by +13% compared to the same quarter last year, beating expectations by nearly +6%.

Notably, every S&P 500 sector delivered results exceeding forecasts, with significant outperformance in sectors such as: Technology, Industrials, Health Care, Financials, and Materials.

This broad strength underscores the resilience of corporate profitability in the first quarter, even in the face of significant policy uncertainty and concerns of slowing economic growth.

Figure 2:

“S&P 500 Sector Earnings: Q1 2025 vs. Q1 2024”

Outlook for the Remainder of 2025

Despite a robust first quarter, the earnings outlook remains uncertain. While recent pauses and tariff de-escalation have relieved immediate pressures, many companies remain cautious due to ongoing unresolved global trade policy risks.

Earnings guidance has become notably conservative. Management teams have flagged rising input costs and diminished visibility into future demand trends. Additionally, it’s important to acknowledge that Q1 earnings reflect activity from January through March, before widespread tariffs announced in early April fully took effect. Increased tariffs could present delayed impacts, pressuring input costs and profit margins as 2025 progresses.

Bottom Line

Q1 2025 marked a solid start, showcasing corporate America’s ability to adapt and thrive amid policy-driven uncertainty. However, sustaining earnings momentum will depend heavily on how effectively companies can navigate a complex and evolving economic landscape.