Weekly Market Recap

Stocks sold off early in the week but rebounded to finish higher after the administration announced a UK trade deal. The Russell 2000 led gains and outperformed the S&P 500, driven by strength in Equal Weight, Value, and High Beta factors. Cyclical sectors broadly outperformed defensive sectors. In another clear sign of investors embracing risk, high-yield corporate bonds outperformed in credit markets, while investment-grade and Treasury bonds lagged. Market volatility eased significantly, with both the VIX and MOVE indices declining as geopolitical tensions continued to de-escalate. The U.S. dollar strengthened, and oil prices rose despite signals from OPEC of increased future production.

Key Takeaways

1. Record Trade Deficit Reflects Tariff Effects

1. Record Trade Deficit Reflects Tariff Effects

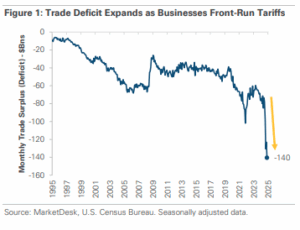

The U.S. trade deficit surged to a record high in March as businesses accelerated imports ahead of President Trump’s tariffs (Figure 1). The widening trade deficit highlights how tariff threats distort economic behavior, complicating assessments of economic health.

Implication: Tariff-related volatility is significantly influencing consumer and business spending, making underlying economic strength difficult to gauge clearly.

2. Imports Drive Q1 GDP Contraction

2. Imports Drive Q1 GDP Contraction

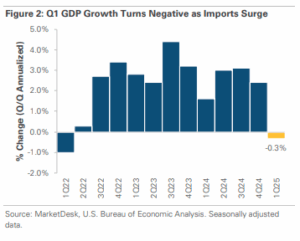

The import surge sharply impacted economic growth in Q1, causing GDP to contract by -0.3%, the first quarterly contraction in three years (Figure 2). The primary driver was a +41.3% jump in imports as businesses front-loaded purchases.

Implication: While Q1 growth slowed due to imports, a normalization in trade could reverse the effect, potentially boosting GDP temporarily in future quarters.

3. Core Economic Growth Remains Resilient

3. Core Economic Growth Remains Resilient

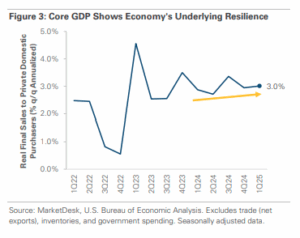

Despite negative headline GDP growth, underlying core economic indicators remained solid. Real final sales to private domestic purchasers grew +3.0%, up from +2.9% in Q4 (Figure 3), highlighting strong private-sector demand.

Implication: The economy’s underlying fundamentals remain healthy, signaling resilience despite trade-related headline weakness.

4. Labor Market Strength Continues

4. Labor Market Strength Continues

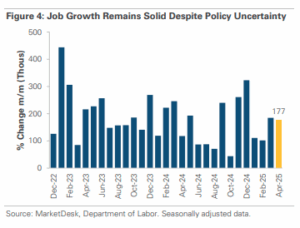

April’s labor market data showed continued strength, with the economy adding +177,000 jobs and unemployment steady at 4.2% (Figure 4). Trade uncertainty seems to have paused major hiring and firing decisions.

Implication: Strong job creation reduces immediate recession fears but delays potential Fed rate cuts, complicating monetary policy timing.

5. Fed Maintains Patient Policy Stance

5. Fed Maintains Patient Policy Stance

The Federal Reserve kept rates unchanged, emphasizing caution and data-dependence amid elevated risks to inflation and employment. Powell highlighted the current policy as appropriate, awaiting clearer signals from the labor market.

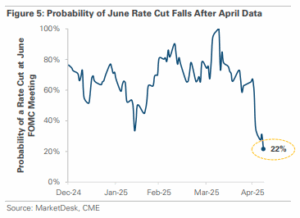

Implication: Stronger-than-expected economic data significantly reduces the likelihood of a June rate cut, pushing investor expectations further out (Figure 5).

6. Mixed Signals Across Asset Classes

6. Mixed Signals Across Asset Classes

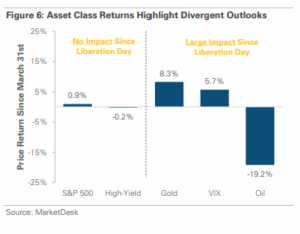

Market signals remain mixed since tariff announcements began (Figure 6). Equities and high-yield bonds recovered their initial losses, yet gold, the VIX, and oil prices reflect ongoing concerns around growth and volatility.

Implication: Equity markets are largely ignoring tariff impacts, while other indicators suggest cautious investor sentiment and lingering growth worries.