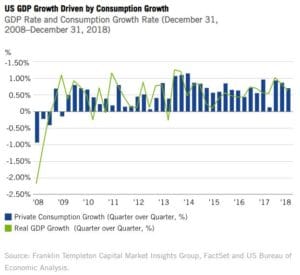

There are clearly many concerns where markets are headed across the globe. A quick search on “US Recession” will bury you with an abundance of headline grabbing results. Global growth is slowing as indicated by various manufacturing and spending data points. China trade tensions continue, and possible political shocks plague the US as well as developed economies across both coasts.

Throw in the uncertainty that central banks have left us with, including the recent Federal Reserve decision to halt interest rate increases. It seems like many feel misguided and generally confused.

I believe a different story is unfolding and the risks are in the Federal Reserves halt of interest rate policy. Their actions clearly indicate that the future economy cannot grind forward, and that was clearly the case in late 2018. That’s when many markets took the elevator down and experts were warning of a deep bear market.

Sidebar: if you’d like to brush up on your bear market history, check out my earlier post here.

So, what do interest rates have to do with markets? Well there has been a long-standing debate that stock prices are being propped up with low rates. Cheap borrowing has caused a debt bubble that could potentially get expensive to service if (and when) rates do move significantly higher.

If my view of continued growth, even slow growth, continues, then the Fed may be forced to throw a rate hike out there. Catching many investors by surprise and bringing back 2018 like moves that hurt account balances.

All in all, rates should be rising. That’s the bottom line. Growing deficits driven by government spending, inflation creeping up with rising wages and fewer foreign investor wanting to buy US debt all add up to higher rates. Possibly, of course.

I believe this is an opportunity to take a proactive stance with portfolio’s and look at what may be sensitive to interest rate moves. Considering “Quality” at the individual holding level is also a factor to consider with what you own. There will come a time when central bankers, the Federal Reserve included, will simply not be able to hold things up. It will have to come down to profitability and future cash flow. Think of the basics, and it’s a matter of time when that happens.

Our strong labor market and consistent consumer spending may continue to support our economy while political tensions and massive government spending continue. I like to ‘err on the side of caution and plan, rather than react to the next shock. No strategy works in every environment, but you can possibly increase your odds of success by knowing what you own and asking “what if things go bad, how will these positions hold up?”

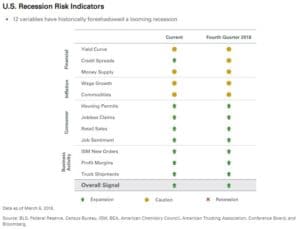

Plus, remember that the crowd is expecting a recession within the next 18 months. This view is already priced into markets, assuming you believe in efficient markets. If you consider various indicators (see image below) you’ll see that conditions are not supportive of a recession in this time frame.

With Britain’s (drawn out) departure from the European Union, China’s economy slowing and many countries facing political strains, the United States continues to be a foundation in the global investment community. Many eyes will be on data points and more clarity of what the future looks like. I am betting on underlying US strength to pull us through while the headlines sort themselves out. In the meantime, you can take a proactive stance to your money and look for quality to protect yourself from future surprises. Your guess is as good as mine on what that will be, but things aren’t as bad as they sound, for now.

Curious how a recession may impact your financial plan? Contact us for a free strategy session or visit ProsperiFi.com for more intelligent financial insights.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. There can be no guarantee that strategies promoted will be successful

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit or protect against a loss in declining market.