Election season brings many hot-button topics and debates. Social Security is one of them.

Election season brings many hot-button topics and debates. Social Security is one of them.

Over the years, I’ve noticed the negative sentiment towards the program grow. Much of it seems fueled by concerns over its potential insolvency. With each cycle, more people believe that Social Security will go broke.

Many of the younger families we serve request to leave projected Social Security benefits out of their financial planning. I also see retirees rush to claim benefits early due to these concerns. It’s an interesting dilemma that financial media has created for millions.

In my view, the condition of Social Security is more stable than many realize. I’m not calling it perfect by any stretch. In the end, it’s a government-run program. It’s littered with issues.

But it’s important to understand the program better and make informed decisions.

Much of the confusion around Social Security comes from a focus on the declining “Social Security Trust Fund”. Keep in mind, that the trust fund issues stem from demographic shifts and longevity. These issues are not related to mismanagement or misappropriation of funds. You can learn more about Social Security waste & abuse here.

It’s important to clarify this difference.

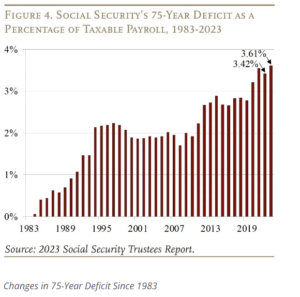

We’re witnessing an accelerating number of baby boomers retire while average lifespans extend. This creates a growing imbalance of benefits paid over the payroll tax revenues collected. Until 2021, Social Security disbursed benefits using current payroll taxes combined with interest from the trust fund.

In 2021 though, the program began using the trust fund’s principal to address the deficit. This trend is expected to continue until 2033 when the trust fund is projected to run out.

Keep in mind, 2021 happens to be near the historic lows of interest earned on the trust fund portfolio. The average interest income earned on the trust fund assets was 1.39% over 2021.

The market-wide interest rate increases have helped the trust fund recover. As of the timing of this post, the trust fund is earning an annualized 4.75%.

This does not translate into a Social Security “bankruptcy”. Initially, payroll taxes will still fund about 77% of projected benefits. By 2033, payroll taxes will carry about 71% of the projected benefits.

We do believe that #RatesHigherForLonger may help the economics of the program.

Social Security has mostly operated on a “pay-go” basis. Meaning, as payroll tax revenue comes in, payments are made to recipients. In 2024, for example, Americans contribute 6.2% of income up to $168,600 to Social Security, matched equally by employers.

These payroll taxes are then used to pay current obligations.

While the situation isn’t ideal, it is manageable.

Some researchers suggest raising payroll taxes by 1.80% to close the funding gap. This could provide much-needed breathing room. This increase may let the program meet its obligations through 2097. But, that assumes no other changes are made. For detailed reporting, please visit the Center for Retirement Research.

Solutions are more likely to be multifaceted. Perhaps including increases to payroll taxes, other considerations may include:

-

adjustments to the income cap on taxes

-

an increase in retirement ages for future retirees

-

changing the definition of disability

- Providing an option to “Opt-Out” of the program entirely

These changes would require significant political negotiation and compromise.

Regardless of what happens in Washington, Social Security can still pay full benefits until 2033 if no changes are made. After that, it can pay about 77% of benefits, based on current projections. This is far from the zero benefits that many fear and the media often preys upon.

I share this not to downplay the issue. I aim to highlight that, while serious, it is not as dire as often portrayed. This situation is manageable and creates many financial planning opportunities. I hope this provides a clearer and more hopeful perspective on Social Security.